Free Risk Management maturity assessment to determine your baseline

Risk Management is the systematic process of identifying, assessing, prioritizing, and mitigating risks that could impact an organization's objectives. It involves understanding potential threats and vulnerabilities and implementing strategies to minimize or avoid adverse consequences. Different types of Risk Management include:

Enterprise Risk Management (ERM): ERM focuses on identifying and managing risks that can affect the achievement of an organization's strategic objectives. It considers a broad range of risks, including financial, operational, reputational, and compliance risks.

Operational Risk Management (ORM): Operational risk management focuses on identifying and managing risks associated with internal processes, systems, and people. It involves assessing risks related to operational efficiency, errors, fraud, business disruptions, and process failures.

IT Risk Management (ITRM): IT risk management focuses on identifying and managing risks related to technology systems, infrastructure, and data. It involves assessing risks such as cybersecurity threats, data breaches, system failures, and the impact of emerging technologies on business operations.

In all these types of risk management, the process typically involves risk identification, risk assessment, risk evaluation, risk treatment, and ongoing monitoring and review. Risk management aims to strike a balance between risk-taking and risk mitigation, enabling organizations to make informed decisions and take actions to protect their interests. Effective Risk Management helps organizations understand and navigate potential challenges, proactively address vulnerabilities, enhance decision-making, allocate resources efficiently, and maintain resilience in the face of uncertainties. By implementing robust risk management practices, organizations can optimize opportunities, protect assets, and achieve their strategic objectives while managing potential threats.

Strategic and Advisory Services for GRC Programs maximize program potential while helping to avoid common pitfalls

Implementing a Risk Management program within companies can present several challenges. Here are some common ones:

1. Risk Awareness and Culture: Building risk awareness and fostering a risk-aware culture across the organization can be challenging. Employees may not fully understand the importance of risk management or may perceive it as an additional burden. Creating a culture that values risk management requires effective communication, training, and engagement.

2. Resource Allocation: Implementing a robust Risk Management program requires allocating sufficient resources, including personnel, technology, and financial investment. Companies may face challenges in securing the necessary resources to build and sustain the program effectively.

3. Risk Identification and Assessment: Identifying and assessing risks across the organization can be complex. Companies may struggle to identify all potential risks, assess their impact and likelihood accurately, and prioritize risks based on their significance to the organization's objectives.

4. Risk Measurement and Quantification: Measuring and quantifying risks can be challenging, especially when dealing with intangible or emerging risks. Companies may face difficulties in establishing consistent risk measurement methodologies and obtaining reliable data for risk quantification.

5. Risk Integration and Coordination: Integrating risk management efforts across various departments and functions can be a challenge. Companies may have siloed risk management practices, making it difficult to achieve a holistic view of risks and coordinate risk mitigation strategies.

6. Risk Monitoring and Reporting: Establishing effective risk monitoring and reporting mechanisms can be a hurdle. Companies need systems and processes to track risks, monitor risk indicators, and generate timely and accurate risk reports for informed decision-making.

7. Continuous Improvement: Maintaining a continuous improvement mindset is essential in risk management. Companies may struggle to adapt their risk management practices to evolving risks, new regulations, and changing business environments. Developing mechanisms for ongoing evaluation and improvement is crucial.

Addressing these challenges requires strong leadership commitment, effective communication, dedicated resources, risk-aware culture, collaboration across departments, investment in risk management tools and technology, and a commitment to continuous improvement. By implementing a robust Risk Management program, companies can enhance their resilience, optimize opportunities, and effectively navigate uncertainties.

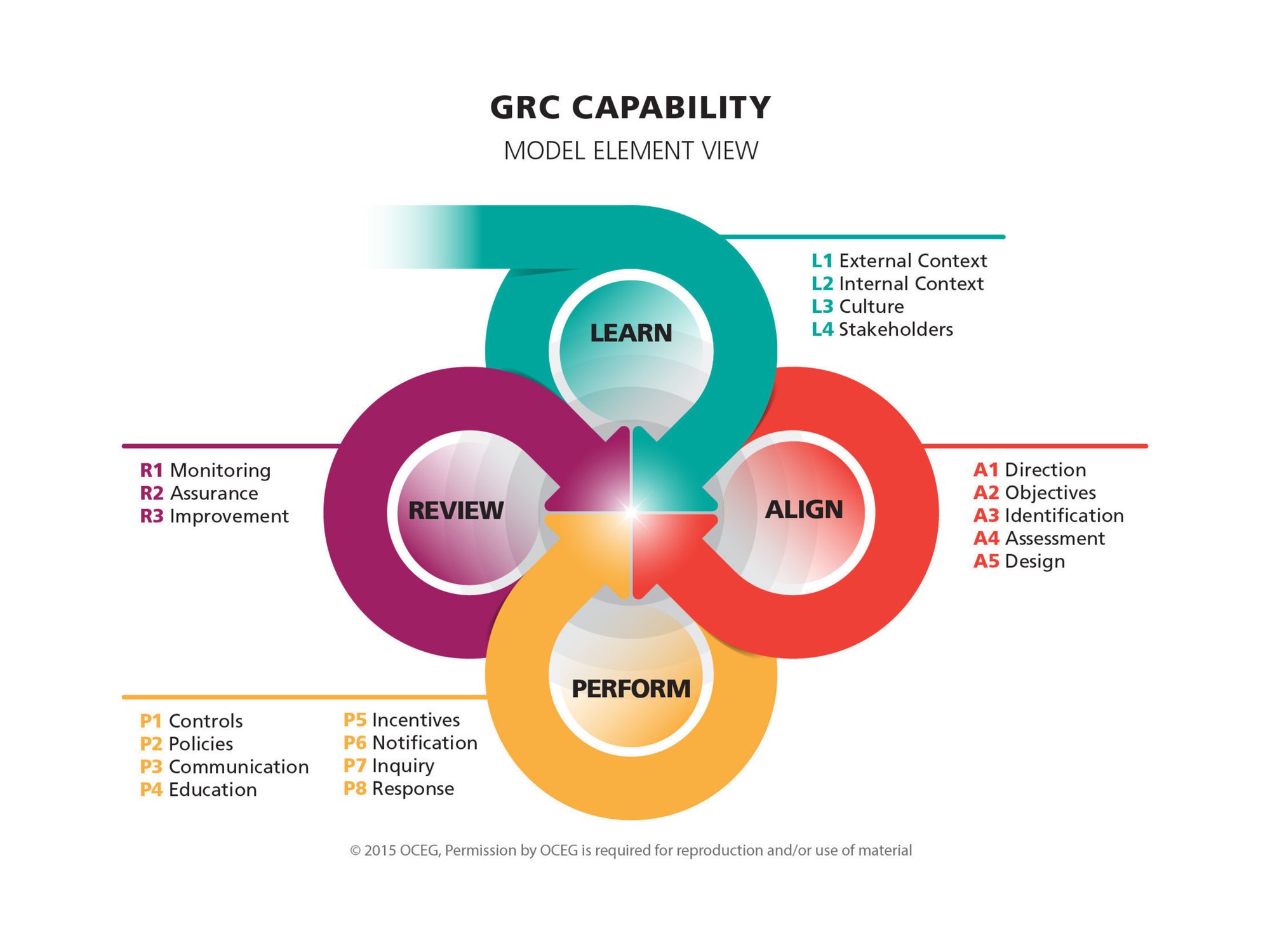

You can automate any process, but is it a best practice GRC business process? Effective GRC implementation projects are impossible without the expertise in business processes. Each engagement is carefully staffed with at least one consultant who brings to the table extensive experience as a GRC practitioner or holds the prestigious OCEG certification.

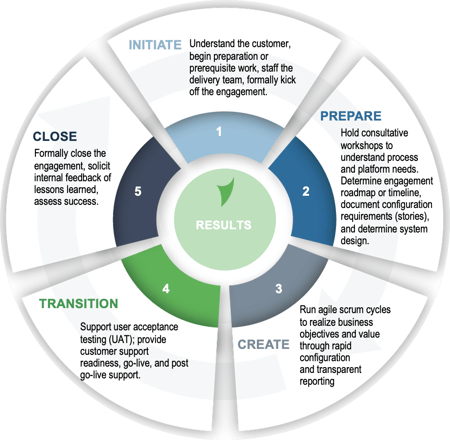

Our certified GRC Consultants truly understand how to implement Risk. Learn more about our methodology for Implementation Services and our team that makes it all possible

We are GRC people, not pushy sales people. We operate in a no pressure environment, where we simply enjoy discussing GRC. Let's start a conversation and explore how Verterim can help you navigate the world of GRC with confidence.

We Know GRC